New DOL Overtime Rule Announced. How Will it Affect Your Business?

A new law is here, expanding overtime pay to 4.2 million exempt workers. The U.S. Department of Labor (DOL) passed the new overtime law on May 18, 2016, that changes the white-collar exemption and who can receive overtime.

What is the new DOL overtime rule?

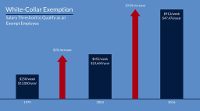

The new law changes what qualifies as an exempt employee. You are not required to pay overtime wages to exempt employees. The overtime law changes the salary threshold. The salary threshold is the minimum annual salary you must pay employees for them to qualify as exempt from overtime wages.

Read More

| In order for an employee to be classified as exempt, the employer must: | |

| Current Exempt Status Rules | New Exempt Status Rules |

| 1. Pay the employee a salary; | 1. Pay the employee a salary; |

| 2. Pay the employee at least the salary threshold of $455 per week ($23,660 per year); | 2. Pay the employee at least the salary threshold of $913 per week ($47,476 per year); |

| 3. Give the employee executive, administrative, or professional duties. | 3. Give the employee executive, administrative or professional duties. |

| Bonuses & commissions do not count towards the salary threshold. | Employers can now count bonuses and commissions toward as much as 10% of the salary threshold. |

Employees who do not meet these rules are nonexempt from overtime wages. This means if a nonexempt employee works overtime hours, you must pay overtime wages.

The minimum salary threshold, according to the new DOL overtime rules, will automatically increase every three years based on wage growth. The first automatic increase will occur on January 1, 2020. Employees who are currently exempt might become nonexempt in the future as the salary threshold increases.

The new law also updates the salary level for a highly compensated employee. To be a highly compensated employee, you must pay the employee at least $134,004 per year. The salary threshold for highly compensated employees will be automatically updated.

What the new overtime law means for your business

You must comply with the new overtime law by December 1, 2016. That gives employers six months to prepare. Small businesses are not exempt from the overtime law. Below are things you can do to comply with the law.

If you have nonexempt employees

If you have nonexempt employees, nothing will change. You will still pay your nonexempt employees their hourly rates along with overtime wages for any overtime hours they work.

If you have exempt employees

If you have exempt employees, you might have to change the way you pay them. The overtime law means you will probably have to pay your employees overtime, unless they earn at least $47,476.

Increase salaries

One option you have is to increase employee salaries above the salary threshold. Salaries need to be at least $47,476 for employees to remain exempt. Depending on what you currently pay your exempt employees, you might have to give large pay raises.

If you also have nonexempt employees, you might want to consider giving them pay raises, too. The raises would prevent your hourly employees from earning wages exceedingly smaller than the wages your salaried employees earn.

Pay overtime wages

If you do not increase exempt employee wages to at least $47,476, your exempt employees will become nonexempt. This reclassification means you will have to start paying them overtime wages.

You will pay your newly nonexempt employees at least one and a half times their regular rate of pay for time worked beyond 40 hours in a week. You might want to convert your employees' salaries into an hourly rate to make overtime pay calculations easier. However, if you choose to continue paying salaries to your employees, you can calculate overtime for salaried employees.

If your employees work many extra hours, the cost of overtime wages will quickly add up. To reduce your payroll costs, you can limit the hours employees can work. Employees cannot work extra time for free, even if they volunteer to do so. Having your employees work any time for free is against the law.

SimpleHR Launches EE Connect Mobile App

The team at SimpleHR is pleased to announce the release of the EE Connect app, the latest addition to our suite of on-line services. EE Connect expands the capabilities of the existing Employee Self Service site by offering a new convenient way for employees to access their information. Using EE Connect allows employees to access employee payroll information, pay check stubs, year-to-date totals, and more with ease and confidence. Read More

One single access account allows the employee to use both EE Connect and the Employee Self Service website. Easy guided setup walks new users through account setup. An optional screen security code provides added security to prevent unauthorized use of the app. EE Connect is available for use on compatible smartphones and other mobile devices.

As a client, you can save time distributing checks stubs by allowing employees with direct deposit to access their pay check stubs through EE Connect or the Employee Self Service website. Both EE Connect and the Employee Self Service website are designed to provide SimpleHR client employees 24-hour access to their employment records; eliminating some of the daily demands placed on the SimpleHR client staff to obtain this information for the employee. Contact the SimpleHR Business Development Department for more information about EE Connect, Employee Self Service and the other time and cost-saving advantages that SimpleHR has to offer.

Free Seminar: Urgent PPACA Compliance Requirements for 2016

Please Join Us:

PPACA Compliance 2016 Requirements – Free Seminar

Date: Thursday, January 14, 2016

Time: 11:00am – 2:00pm

Location: Doolittle Institute, 73 Eglin Pkwy, Suite 112

Fort Walton Beach, FL 32548

(JG Plaza at Uptown Station)

Speakers: David Jefferson & Shannon Cruz, SimpleHR

David Barton & Scott Fenstermaker, Employee Benefits Solutions

Luke Wolkers, Rogers Benefit Group

You are invited to attend a very important seminar presented by SimpleHR in conjunction with our partners at Employee Benefits Solutions (EBS) and Rogers Benefit Group (RBG). This seminar will have vital information on upcoming reporting requirements under the Patient Protection and Affordable Care Act (PPACA). Read More

Starting in 2016, for the 2015 calendar year, employers with 50 or more full-time and full-time equivalent employees will be required to file critical reports no later than February 29th. We will cover information on the PPACA and employers requirements to "play or pay". We will also cover the important reporting requirements of IRC Sections 6055 and 6056, to include the filing of the 1094-B and 1095-B, and 1094-C and 1095-C. We will have time at the end for specific questions and answers.

Lunch will be served so please RSVP no later than January 12th, 2016 to Shannon Cruz, Benefits Manager, at 850-650-9935 extension 37. Seating is limited so we ask that no more than 2 individuals from your organization attend.

Request Information

Find out how SimpleHR can be the employee management solution for you!

Did You Know

- The average settlement of a negligent hiring lawsuit exceeds $1.6 million.

- The US Department of Labor estimates that the average cost of a bad hiring decision can equal 30% of the first years potential earnings.

~ News Archives ~

* SimpleHR provides HR assistance as a Client benefit. This assistance is provided by an HR professional as general information and is not a substitute for legal advice.